The Government Child Care Subsidy makes early learning more affordable for many Australians.

Find out below about the changes starting July 2023.

The Government Child Care Subsidy makes early learning more affordable for many Australians.

Find out below about the changes starting July 2023.

From July 2023, the Australian Government will be increasing Child Care Subsidy (CCS) rates for families.

This is incredible news for families, with the changes going some way towards making child care more affordable and inclusive for Australian families.

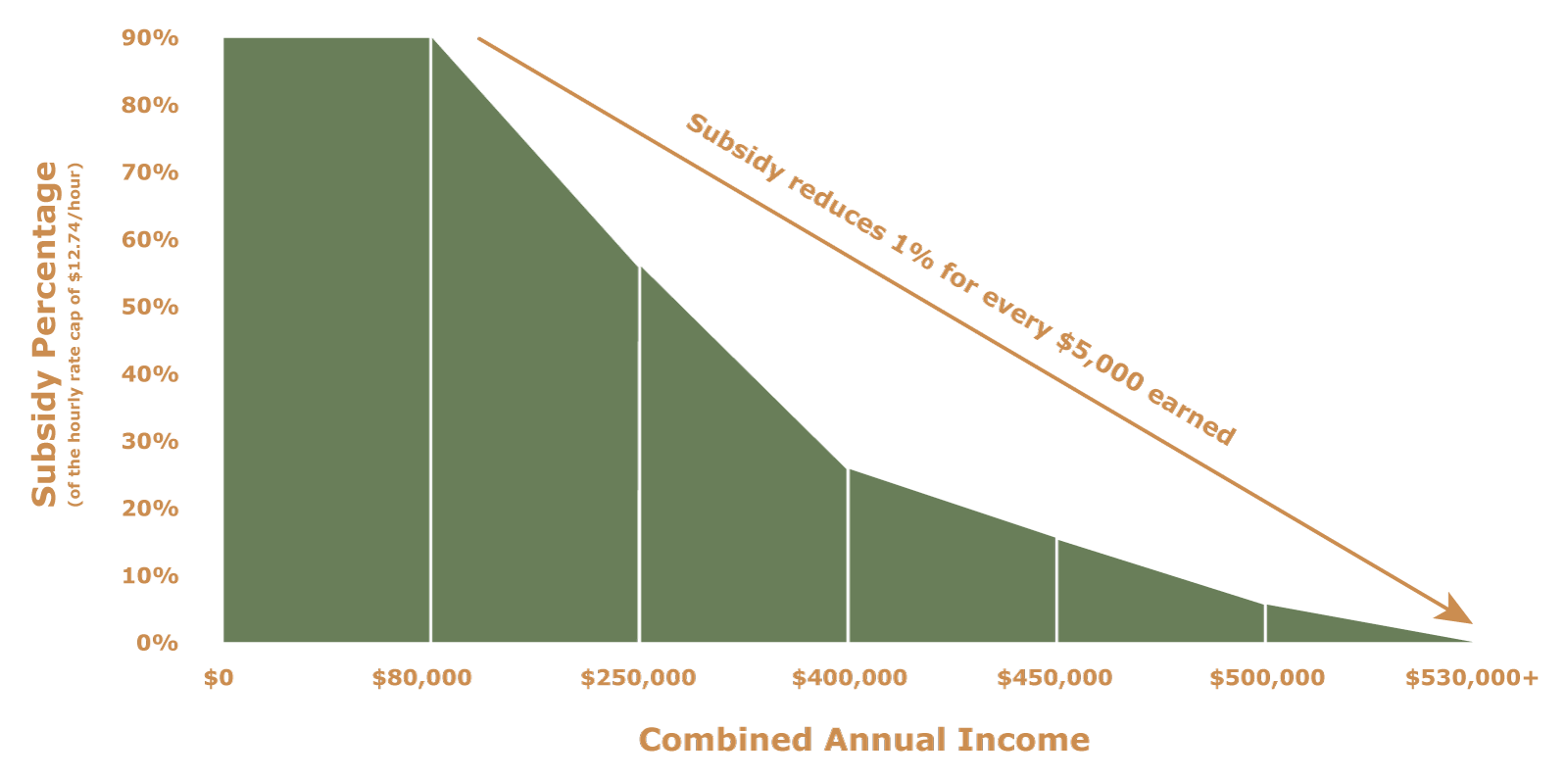

*Based on eldest or only child. Families with more than one child may be eligible for a higher subsidy for their second child and younger children.

*The $12.74 hourly cap applied above is a 2022 figure and is subject to change with the Commonwealth Government’s announcement of the 2024 CCS hourly cap changes.

To read more about combined annual income and the annual cap, click here for further information from Services Australia.

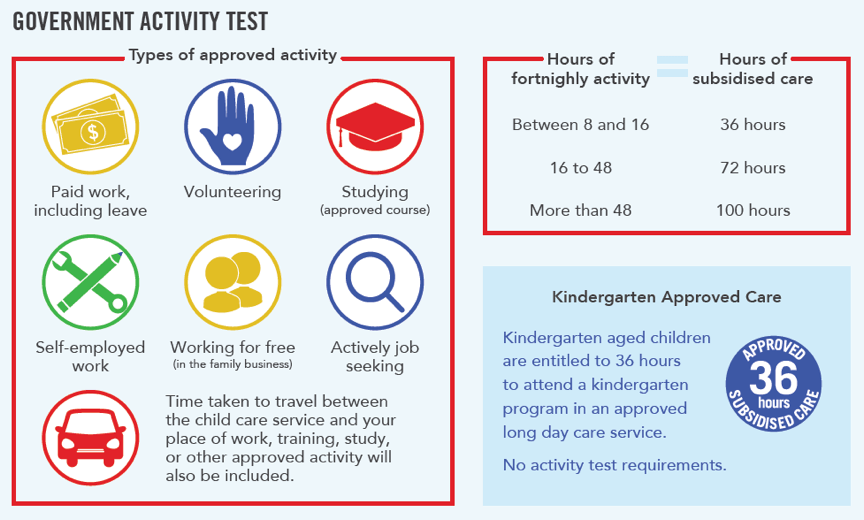

This will depend on three factors:

The subsidy you receive and any applicable cap will depend upon your own personal circumstances and is subject to your combined family income, hours of recognised activity and child care details. For more information visit The Department of Education’s website at https://www.servicesaustralia.gov.au/child-care-subsidy